Partnering With Passive Fund Sponsors That Have Your Back

What to look for in passive parents.

This article is part of Morningstar's Guide to Passive Investing special report.

At our eighth annual Morningstar ETF Conference in September, we previewed the findings of a forthcoming research paper that examines stewardship practices among the largest sponsors of index mutual funds and index-tracking exchange-traded funds. This research assesses the degree to which these funds' sponsors have aligned their own economic interests with their shareholders'. The full study can be found in the Research Library on Morningstar's corporate website.

It is perhaps more intuitive that investors in actively managed funds should consider stewardship when selecting funds, but strong stewardship is every bit as relevant for investors in passively managed funds. We found that firms that align their interests with those of fundholders by charging low fund fees, sharing a greater portion of revenues derived from securities lending, taking a disciplined approach to product development, and investing in portfolio management infrastructure have delivered above-average peer-relative performance.

In conducting this analysis, we used data from Morningstar's U.S. database of open-end mutual funds and ETFs. To supplement the data, we surveyed 10 firms that have been assigned Parent Pillar ratings and ranked among the largest providers of passively managed mutual funds and ETFs as of March 2017. These firms are presented in Exhibit 1. We will subsequently refer to this group as the "surveyed firms."

A Concentrated Industry As Exhibit 1 shows, the ranks of sponsors of passively managed funds are dominated by the surveyed firms. This measure includes assets in U.S.-domiciled index mutual funds and ETFs, as well as assets managed by Dimensional Fund Advisors. While DFA's funds don't track indexes, the firm takes a systematic approach to security selection and portfolio construction, and Morningstar has long classified them as "passive" for purposes of monitoring asset flows. As of December 2016, the surveyed firms represented nearly $5 trillion in assets and more than 90% of U.S. passive fund assets.

This degree of concentration among sponsors of passively managed funds is not a recent phenomenon. The top firms' share has held steady for years as they've continued to pick up a majority of new flows into passive funds. Solid organic growth and market dominance are unquestionably positive from these fund sponsors' point of view, but not all of them have passed along economies of scale to fund investors. Understanding the differences between these firms' ownership structures provides context to better understand their business decisions that in turn reflect on their stewardship.

Differing ownership structures result in different sets of stakeholders and in turn shape asset managers' product development and pricing decisions, which reflect directly on these firms' stewardship. For example, Vanguard is mutually owned by its fund shareholders and runs its funds at cost, so it ultimately passes economies of scale on to its fundholders in the form of lower fees. TIAA is a nonprofit organization, originally established to offer retirement products for teachers and nonprofit workers. DFA, Fidelity, and Van Eck are privately owned.

Public ownership does not preclude a firm from achieving alignment with their funds' shareholders. For instance, Schwab has tactfully balanced competing stakeholders' financial interests. Schwab overhauled its fund lineup in 2009 to offer mostly broadly diversified portfolio building-block funds and has aggressively cut its funds' fees and investment minimums. Schwab can offset lower fund fee revenue through net interest revenue and its advisory services and brokerage sales. This satisfies equity shareholders while fund investors gain greater access to inexpensive, broadly diversified funds. Similarly, privately owned Fidelity offers cheap core building-block funds that should serve investors well.

Sharing the Pie Sponsors of passive funds can and, in our opinion, should share the benefits of greater scale with investors by reducing funds' expense ratios and sharing a greater portion of funds' securities-lending revenue with fundholders. Most sponsors' expense ratios have fallen on both an equal- and asset-weighted basis during the past decade. Morningstar has previously documented that lower expense ratios are perhaps the single most reliable predictor of future relative performance.[1] Vanguard, Fidelity, TIAA, and Schwab charge the lowest fees, on average--likely because these firms mostly offer funds tracking broad-based market-cap-weighted indexes. Firms such as DFA, WisdomTree, and PowerShares tend to offer more funds with complicated strategies and, accordingly, command higher fees across the board.

Funds' expense ratios are prominently displayed and easy to compare across fund types and providers, but information on securities-lending revenue is tucked away in funds' annual reports. These details are worth digging into because firms can demonstrate alignment with investors by passing along a greater portion of securities-lending revenue to fundholders. Most firms state that 100% of net security-lending revenue is passed back to the fund. "Net" is the key word here. Costs associated with the securities-lending program and fees paid to the lending agent are deducted from the gross securities-lending revenue figure. Of the surveyed firms that disclose lending agent fees, Schwab pays the lowest proportion of securities-lending revenue collected to its lending agent, at around 10%, with breakpoints down to 7.5%. BlackRock funds pay the largest percentage of gross securities-lending revenue, at around 29.5%. Furthermore, BlackRock Institutional Trust Company, an affiliated entity, acts as its lending agent. So, the funds pay securities-lending fees to another division within BlackRock.

(Don't) Churn, Baby, Churn Though not as immediately measurable, but every bit as intuitive as fees, fund sponsors' product development strategies offer additional insight into their alignment with fundholders. Frequent fund launches and liquidations indicate that a firm's product development is more sales-oriented than investment-oriented. Fund companies that keep investors' interests at the center of the product-development process tend to show restraint in bringing new funds to market. These sponsors predominately focus on strategies that have long-term investment merit rather than funds that will attract assets but may be harder for investors to hold, such as volatile niche strategies.

Fund closures can have a negative impact on investors. Product liquidations may be a residual effect of an undisciplined approach to product development and serve as further evidence of a firm prioritizing its own economic interests over its investors'. During the five years through June 2017, Vanguard, Schwab, PowerShares, and DFA demonstrated the greatest discipline with respect to product development as these firms' combined fund launches and liquidations measured the smallest as a percentage of their funds available at the start of the measurement period. On the other hand, Van Eck, WisdomTree, Fidelity, and BlackRock, and State Street have launched or closed the highest percentage of their offerings.

Tying It All Together Successful investing hinges on putting yourself in the best position to maximize favorable outcomes. Beyond selecting a fund that tracks a well-constructed index and charges a low fee, choosing a fund sponsor that aligns its interests with its fundholders' increases the odds of a good outcome.

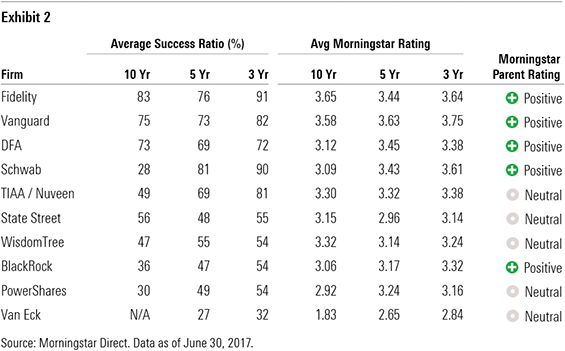

Exhibit 2 presents a pair of measures of success aggregated at the fund-sponsor level across the surveyed firms as of end-June 2017. The success ratio measures the percentage of funds that outperformed their respective Morningstar Category averages out of a fund sponsors' available offerings at the beginning of the measurement period. The success ratio classifies funds that are shuttered during the measurement period as unsuccessful, but it does not account for the magnitude of out- or underperformance. To account for risk and the magnitude of funds' out- or underperformance, Exhibit 2 also presents the equally weighted Morningstar Rating for funds, known as the star rating, for each surveyed firm during the same look-back periods. The star rating is a backward-looking risk-adjusted return measure that compares a fund's returns against its category peers.

Vanguard, Fidelity, and DFA score well across both measures and during all look-back periods. These three fund sponsors have diligently managed their fund lineups and avoided product churn. Vanguard and Fidelity consistently charge low category-relative fees among passive-only peers. DFA's average fee ranks in the more expensive half of the surveyed firms' average fee, but DFA's average fee is low compared with all funds in an investors' opportunity set. Schwab is an example of a fund sponsor that has made material improvements to its lineup in the past decade. Its success ratio measured 28% for the trailing 10 years but jumped to 81% when using a five-year look-back period and to 90% when using a three-year measurement period. The success ratio includes liquidated funds as "unsuccessful" offerings. Schwab liquidated a large portion of its funds during the third quarter of 2009 before launching its ETFs. Also, the firm reduced expense ratios across its menu of funds during the past decade.

Conversely, BlackRock, State Street, PowerShares, WisdomTree, and Van Eck charged higher category-relative fees measured against other passive fund peers and exhibited higher product churn. As of June 2017, these sponsors' trailing success ratios and star ratings were typically lower than those of the other surveyed firms. The firms with the highest success ratios and average star ratings tended to be those that best align their interests with those of their funds' shareholders and earn Positive Parent Pillar ratings.

When selecting funds, investors can more readily pinpoint sponsors that prioritize fundholders' interests by looking for those that:

- Maintain a disciplined approach to product development. Look to partner with firms that emphasize investment merit over marketability when crafting their lineup. Schwab has thoughtfully managed its product offerings since culling its lineup in 2009. DFA shines here, too, because it has closed only four funds in the past 10 years. Vanguard has never closed an ETF.

[1]Kinnel, R. 2016. "Predictive Power of Fees: Why Mutual Fund Fees Are So Important ." Morningstar. May 5, 2016.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click

for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets,

or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64dafa24-41b3-4a5e-aade-5d471358063f.jpg)